Sales Tax -- Using the Destination Tax Configurator

This feature is currently not exposed to non-Sniperdyne NOPS users.

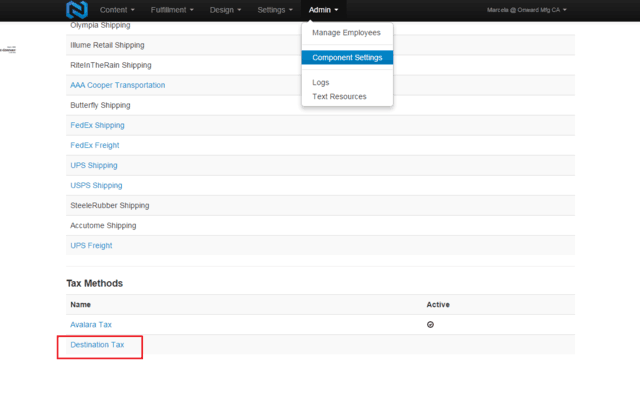

Go to Admin->Component Settings and select "Destination Tax"

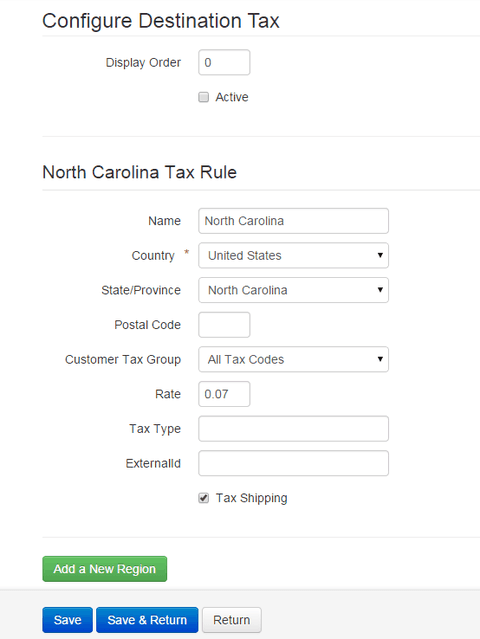

This is the destination page.

For example on that page you can set a tax code and rate for specific location (Country, State, Postal Code).

The premise is that a destination usually dictates a tax rate. If a tax code is not defined for a specific location then it will use the default tax code.

All this logic only applies if the customer is taxable.

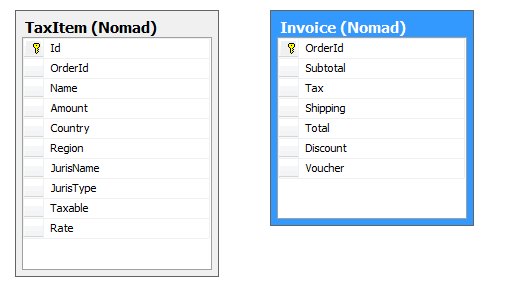

When order is created in Nomad; it looks for location matches and stores the taxes information by item into

[Nomad].[TaxItem] table. Then we store the sum of those items into [Nomad].[Invoice] table, including freight tax.

The new order is inserted into *[dbo].[oeordhdr_sql]* the following are fields related with taxes:

*tax_cd*. We get this from settings; if [INVOICE].[Tax] > 0 it uses TaxCode value from [Nomad].[Setting] if it's 0 we use NonTaxCode In the near future this value will come from the destination rule code depending on the different matches.

*tax_pct*. It is the rate sum of all tax items in [Nomad].[TaxItem] multiplied by 100

- *tot_tax_amt*. It is the sum of item unit price * qty of each taxable item in [Nomad].[LineItem] table

- *sls_tax_amt_1*. This value is coming from [INVOICE].[Tax] and it's the sum of all tax items in [Nomad].[TaxItem] including freight tax

- *tax_fg*. If [INVOICE].[Tax] > 0 it is 'Y' if not it is 'N'

- *tot_tax_cost*. This is the sum of cost * qty of each taxable item in [Nomad].[LineItem] table

Note: One item is taxable if the flag *[tax_fg]* is 'Y' on *[dbo].[imitmidx_sql]* table.